Government

Understanding Property Taxes in Deerfield Township

Property tax, often referred to as "millage," is calculated based on a property's taxable value. Specifically, it's the amount charged per $1,000 of taxable property value. The County Treasurer's office manages these collected funds, which are then distributed by the County Auditor's office to the various taxing jurisdictions. It's important to note that revenues from specific levies (other than general operating levies) are legally restricted for their stated purposes.

Assessed Value in Ohio: In Ohio, the assessed value of real property—the figure used to calculate taxes—is set at 35% of its estimated true market value. Property assessments are updated annually.

Deerfield Township's Property Tax Collection: Deerfield Township collects property taxes through two main categories:

- Inside Millage: This portion does not require a public vote and is capped at 10 mills under Ohio law. Deerfield Township currently allocates 0.86 mills for general operations and 1.44 mills for Road and Bridge maintenance, totaling 2.30 mills.

- Outside Millage: This portion requires voter approval. The Township's total approved outside millage is 11.80 mills, distributed as follows: 6.80 mills for Fire operations, 4.00 mills for Police operations, and 1.00 mill for Parks and Recreation.

Distribution of Property Tax Revenue: While property taxes are Deerfield Township's most significant and stable revenue source, accounting for approximately 85% of its total revenues, the Township itself receives only a small percentage of the total property taxes paid by its residents. The majority of these taxes are directed to local school districts and various levies imposed by Warren County.

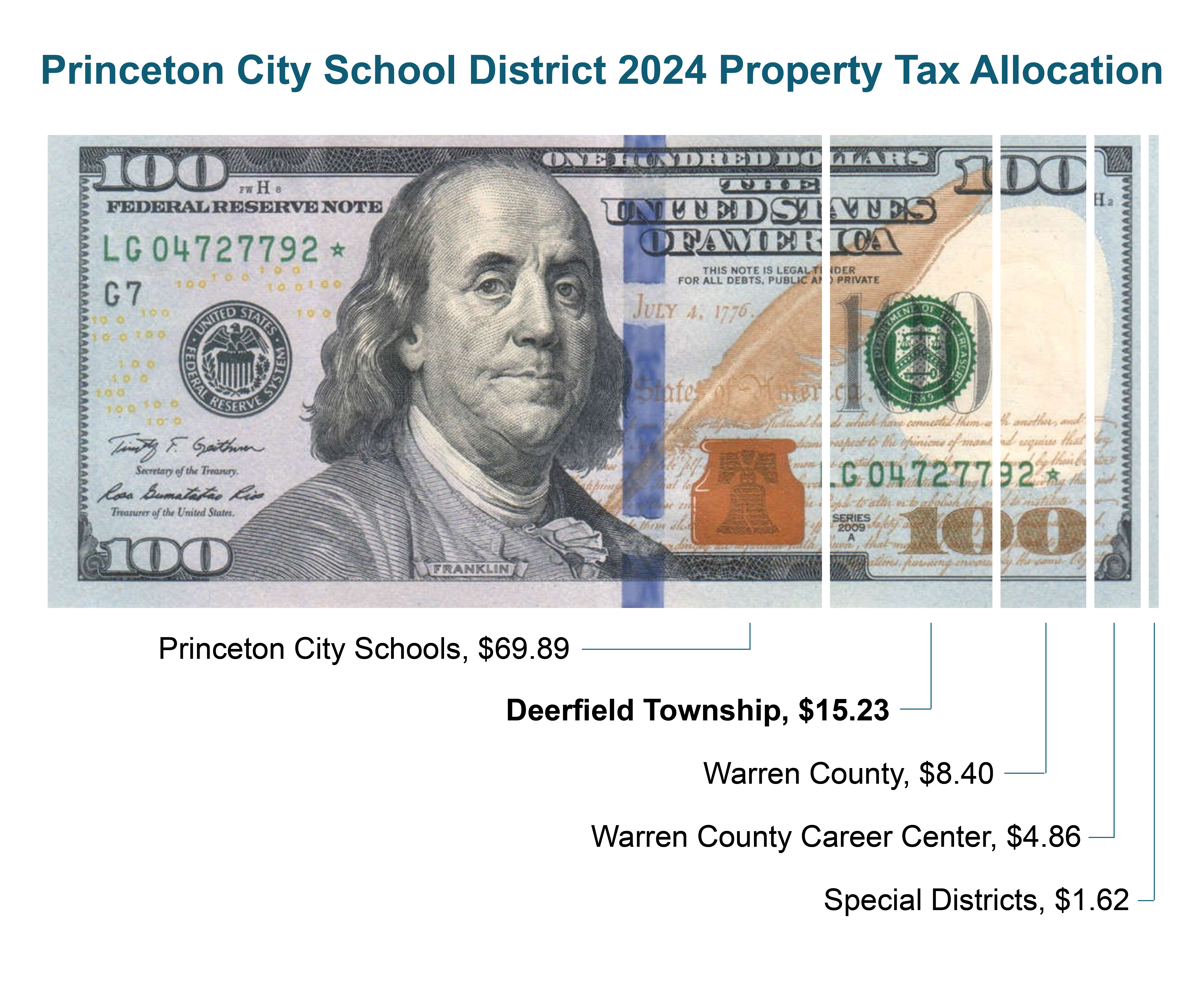

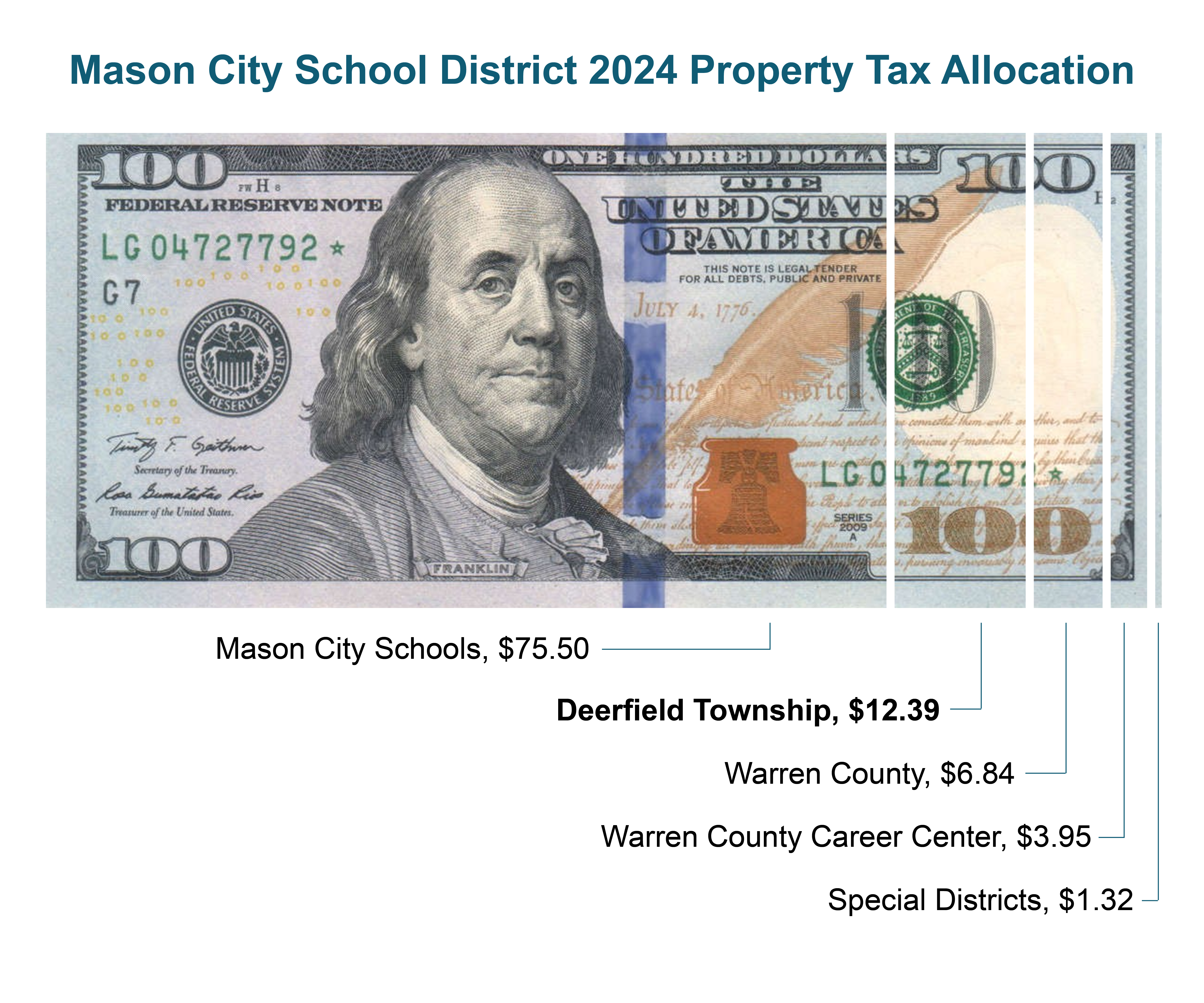

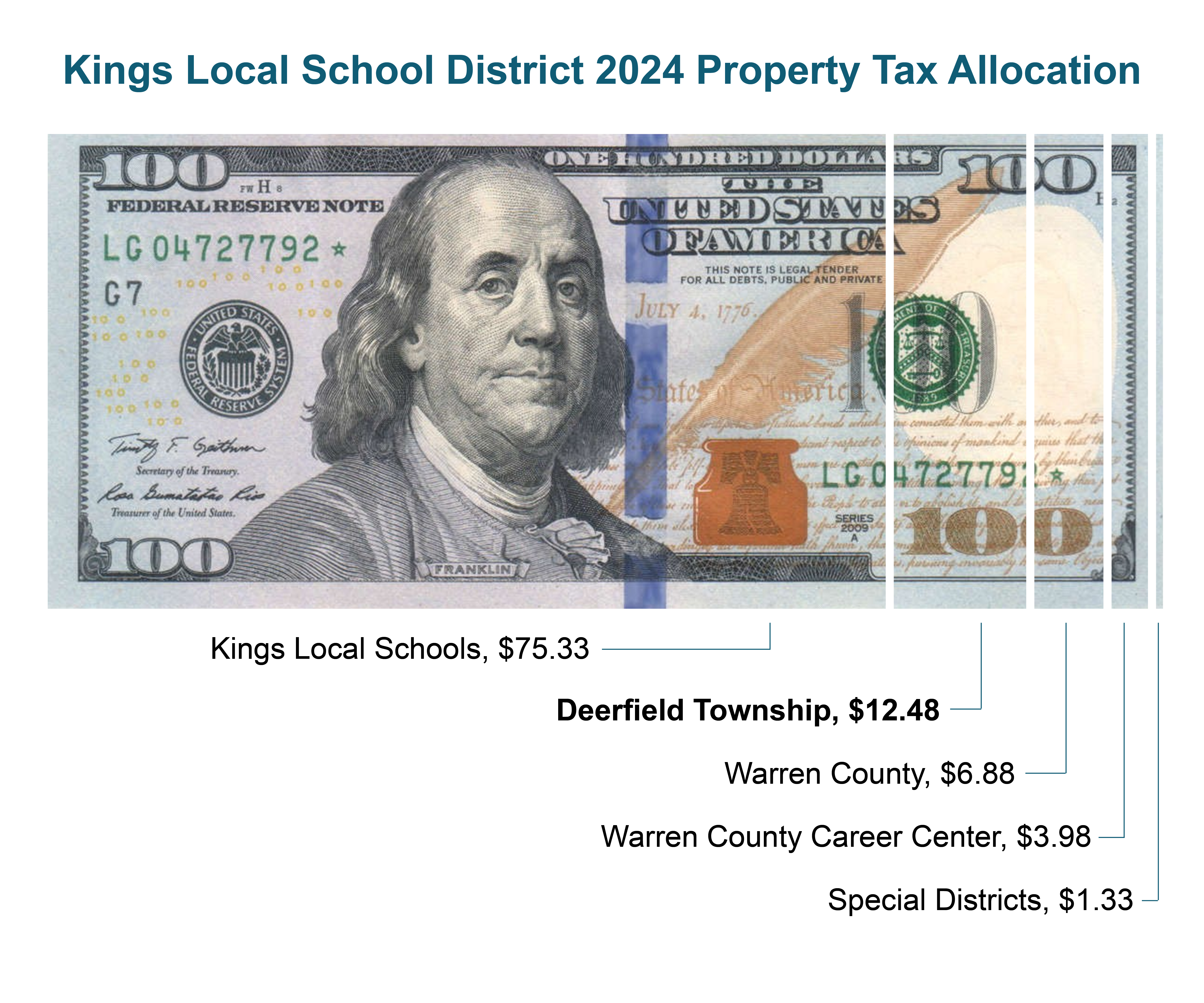

Example Allocation: The following example illustrates how every $100 in property taxes paid on a Deerfield Township home for tax year 2024 (collected in 2025) is allocated. This includes distributions to various school districts such as Mason City School District, Kings Local School District, and Princeton City School District.

Mason City School District

2024 Tax Property Allocation

Kings Local School District

2024 Property Tax Allocation

Princeton City School District

2024 Property Tax Allocation